Social Security Fairness Act: A Critical Vote Looms – What You Need to Know

Hey everyone, let’s talk about something that affects us all – Social Security. Specifically, a bill making its way through Congress that could significantly impact millions of Americans: the Social Security Fairness Act. This isn’t just some dry political debate; it’s about real people, real lives, and real retirement security. And a crucial vote is coming up soon. So, let’s dive in and unpack what’s at stake.

Introduction: The Fight for Fairer Retirement

For decades, Social Security has been a cornerstone of American retirement planning. It’s the safety net that millions rely on to make ends meet after a lifetime of work. But the system isn’t perfect, and for many, it feels far from fair. The Social Security Fairness Act aims to address some of these longstanding inequities, particularly for those who dedicated their lives to public service. This isn’t about handing out free money; it’s about correcting historical injustices and ensuring that those who served our country receive the benefits they rightfully earned. This article will break down the key aspects of the bill, its potential impact, and the upcoming critical vote in Congress.

Understanding the Core Issue: The Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO)

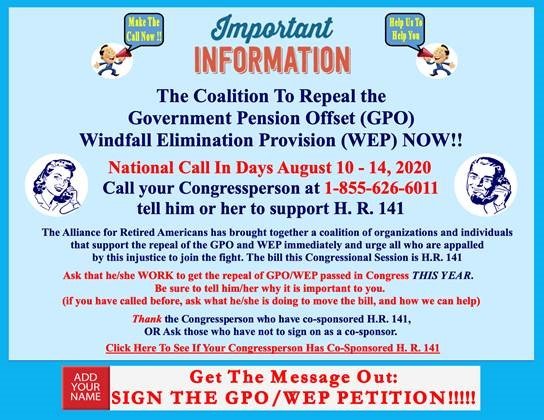

At the heart of the Social Security Fairness Act lies the attempt to repeal two particularly controversial provisions: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These provisions, enacted decades ago, unintentionally penalize individuals who worked both in the public sector and the private sector, or who receive a pension from a government job.

-

The Windfall Elimination Provision (WEP): Imagine someone who worked for a state government for 20 years and also contributed to Social Security through part-time private sector jobs. Under WEP, their Social Security benefits are significantly reduced, even if their combined earnings are relatively modest. The rationale behind WEP was to prevent individuals from receiving "double dipping," but in reality, it often results in significantly lower benefits for those who deserve more.

-

The Government Pension Offset (GPO): This provision affects primarily surviving spouses of public sector employees. It reduces the survivor benefits they receive based on their deceased spouse’s government pension. This can leave surviving spouses with drastically reduced income, especially if they didn’t have a long work history in the private sector.

Think of it this way: These provisions were designed with good intentions, but their implementation has had unintended and often devastating consequences for many hardworking Americans. The Social Security Fairness Act seeks to rectify this situation.

The Social Security Fairness Act: A Path to Justice?

The Social Security Fairness Act is a straightforward piece of legislation: it aims to repeal both WEP and GPO. This means that those affected would receive the Social Security benefits they were originally entitled to, without the arbitrary reductions imposed by these provisions.

This isn’t a radical overhaul of the Social Security system; it’s a targeted adjustment designed to address a specific area of unfairness. Supporters argue that it’s simply a matter of fairness and correcting a long-standing injustice. They point to the fact that many affected individuals dedicated their careers to public service, often at lower salaries than their private sector counterparts, only to find their retirement security compromised by these provisions.

Who Benefits from the Social Security Fairness Act?

The potential beneficiaries of this act are numerous and diverse:

- Teachers: Many teachers work in public schools and contribute to Social Security through their earnings. WEP and GPO often significantly reduce their retirement income.

- Police Officers and Firefighters: These public servants often face dangerous working conditions and contribute to Social Security, yet their benefits are frequently reduced due to these provisions.

- Federal Employees: Those working for the federal government often have pensions, making them vulnerable to the GPO and WEP.

- Surviving Spouses: Widows and widowers of public sector employees are particularly hard hit by the GPO, often facing financial hardship in their later years.