The Senate’s Final Stand: A Fight for the Future of Social Security

Let’s be honest, talking about Social Security isn’t exactly a cocktail party conversation starter. But it should be. It’s the bedrock of retirement security for millions of Americans, and right now, its future is hanging in the balance. The Senate is in the midst of a crucial final push to safeguard Social Security benefits, and understanding what’s at stake is more important than ever. This isn’t just about numbers and legislation; it’s about the dreams and livelihoods of our parents, grandparents, and ourselves.

This article will cut through the political jargon and give you a clear, straightforward look at the Senate’s debate, the challenges facing Social Security, and what you can do to make your voice heard. Think of me as your friendly neighborhood explainer, ready to demystify this vital issue.

The Looming Crisis: Why We Need to Act Now

Social Security, for those unfamiliar, is a social insurance program providing retirement, disability, and survivor benefits. It’s funded through payroll taxes, meaning a portion of your paycheck goes towards supporting the system. The problem? The system is facing a significant funding shortfall in the coming years. This isn’t some distant, hypothetical threat; it’s a projected reality.

Several factors contribute to this crisis:

- Aging Population: The baby boomer generation is entering retirement, placing a larger strain on the system than ever before. More retirees mean more benefits being paid out.

- Increased Life Expectancy: People are living longer, which is wonderful, but it also means they’re drawing Social Security benefits for a longer period.

- Declining Birth Rates: Fewer younger workers are entering the workforce to contribute to the system, further exacerbating the imbalance.

These factors combined create a perfect storm, threatening to reduce benefits or increase taxes significantly unless Congress takes action. The consequences of inaction are stark: reduced retirement income for millions, potentially pushing many seniors into poverty. Imagine your parents, or even yourself, facing a drastically reduced retirement income – that’s the reality we’re staring down.

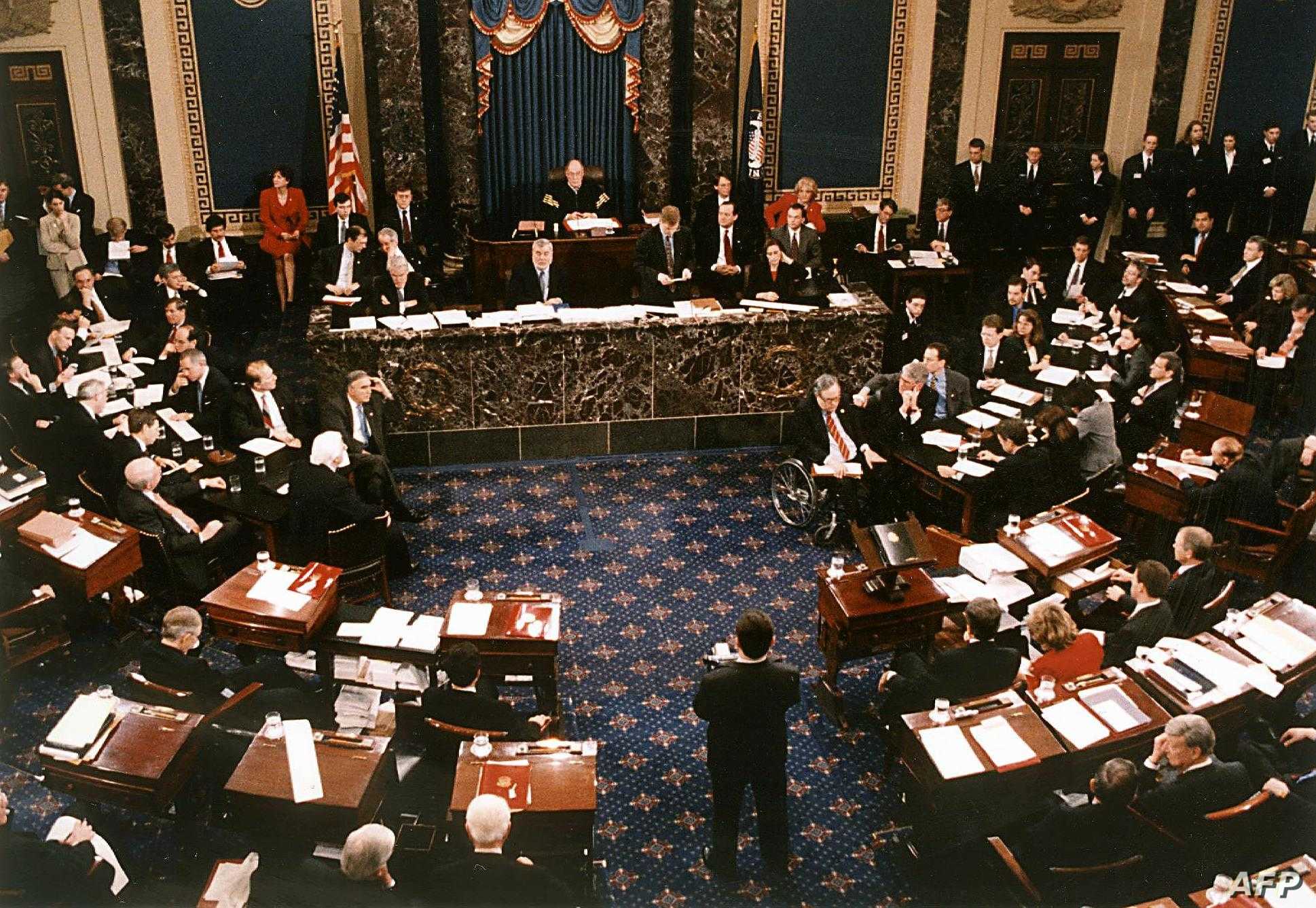

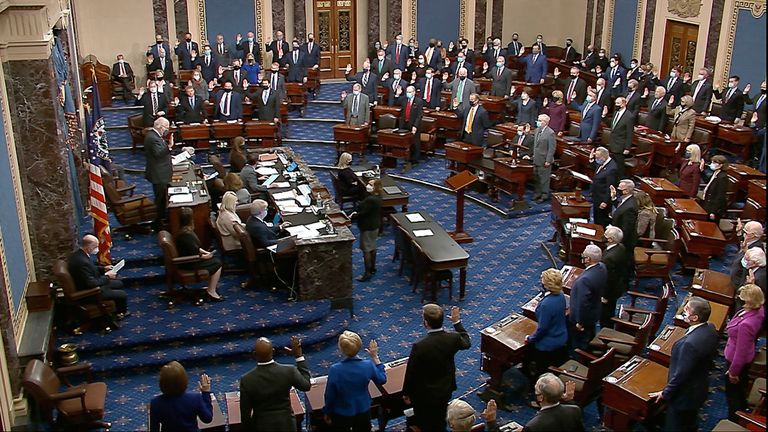

The Senate’s Battleground: A Deep Dive into the Debate

The Senate is currently grappling with various proposals aimed at shoring up Social Security. These proposals generally fall into a few categories:

- Raising the Retirement Age: This involves gradually increasing the age at which individuals can begin receiving full Social Security benefits. While this might seem like a simple solution, it disproportionately affects lower-income workers who often have shorter life expectancies and may not be able to work until a later age.

- Increasing the Taxable Wage Base: Currently, Social Security taxes only apply to earnings up to a certain limit. Raising this limit would bring more high-income earners into the system, generating additional revenue. This is a contentious issue, with some arguing it’s unfair to tax high earners more.

- Cutting Benefits: This is the most unpopular option, involving reducing benefits for current and future retirees. This would have devastating consequences for millions of vulnerable seniors.

- Investing Social Security Trust Funds: Some proposals suggest allowing Social Security to invest its surplus funds in the stock market or other assets to generate higher returns. This is a risky strategy, as market fluctuations could jeopardize the system’s stability.

- Expanding the Tax Base: This involves expanding the number of people paying into the system. This could include taxing certain types of income that are currently exempt, or broadening the definition of "employment" to include more gig workers and independent contractors.

The debate in the Senate is fierce, with Republicans and Democrats often clashing on the best approach. Some Republicans favor more conservative solutions like raising the retirement age or cutting benefits, while Democrats generally prefer options that involve raising taxes on higher earners or expanding the tax base. Finding a bipartisan solution is proving incredibly challenging, highlighting the deep partisan divides that plague our political system.

Think of it like a complex puzzle with no easy answers. Each piece (each proposed solution) has its pros and cons, and finding the right combination that satisfies everyone is nearly impossible.

Real-Life Impacts: Stories from the Front Lines

It’s easy to get lost in the numbers and statistics, but let’s not forget the human element. Social Security isn’t just a government program; it’s the lifeline for millions of Americans. Consider these scenarios: